On Monday morning, my social media feeds blew up with the first bit of good public media-adjacent news in a while: Sesame Workshop, the makers of Sesame Street, had entered into a new distribution deal with the streaming service Netflix after losing their decade-long contract with HBO.

Back in 2015, Sesame Workshop negotiated with HBO to allow new Sesame Street episodes to continue to air on PBS…but only after waiting several months. It was a divisive move that in some ways hurt efforts to save the Corporation for Public Broadcasting’s funding during the first Trump Administration. Big Bird’s paycheck now comes from HBO, the logic went, why bother funding public media?

The new deal, thankfully, allows new Sesame Street episodes to air on PBS and through PBS Kids the same day as Netflix. As I noted on Monday, this is a great development for anyone who cares about public television: There is no program that is more foundational to public media, in my view, than Sesame Street. Allowing new episodes to air on PBS the same day as Netflix not only reinforces public media’s mission, but also shows that the fates of Sesame Street and public media are intertwined.

But the most newsworthy revelation wasn’t about when new episodes would air - it was about Sesame Workshop’s finances. Check out these headlines:

“Sesame Street saved by streaming deal with Netflix” - The Guardian

“‘Sesame Street’ Saved, Inks New Streaming Deal With Netflix” - The Hollywood Reporter

They piqued my interest because they hint at a near-certain demise for Sesame Workshop. I knew the nonprofit had been going through some financial difficulties, but Sesame Street is a cultural behemoth: Is it possible that the show was on the verge of being cancelled? Can we really say Sesame Street was “saved?”

Let’s take a quick look using Sesame Workshop’s most recent 990s.

But first, a few Semipublic updates

I started this Substack a month ago with two main objectives: First, to discuss public media’s past, present, and future using real data (and not just estimates); and second, to house that data on a public platform. Semipublic’s newsletters are always free to read, but access to the dataset - the most complete, I believe, outside of CPB - only comes with a paid subscription to Semipublic.

I’m excited to announce several new additions to the dataset:

First is the data of every AFR or FSR submitted to CPB for FY23. Not all form responses have been uploaded yet (I’ve tried every OCR solution under the sun - AI models, Python libraries, etc - and none are faster or more accurate than manually inputting them) but all revenue and donation data are now available to subscribers.

Additionally, thanks to the power of n8n, I’ve been able to collect every CPB grant from 2019 until now (2024’s were just released!) as well as the 990s of several public media entities (including Sesame Workshop) going back to tax year 2013. Both of these sets of data, as well as the AFR/FSR data, are organized into “Models,” which are essentially databases optimized for Metabase.

Two big, labor-intensive items remain on my roadmap heading into the summer:

Finishing the AFR & FSR dataset.

Downloading, organizing, and inputting key information from all station Audited Financial Statements (AFS) from 2023.

This is an incredible wealth of information, one that has taken a lot of time and expertise to curate, and I’m excited to be making so much progress. If you think this data might be useful to you, or if you just think taking a peek behind the public media curtain is useful, consider becoming a paying subscriber.

Sesame Street’s HBO years

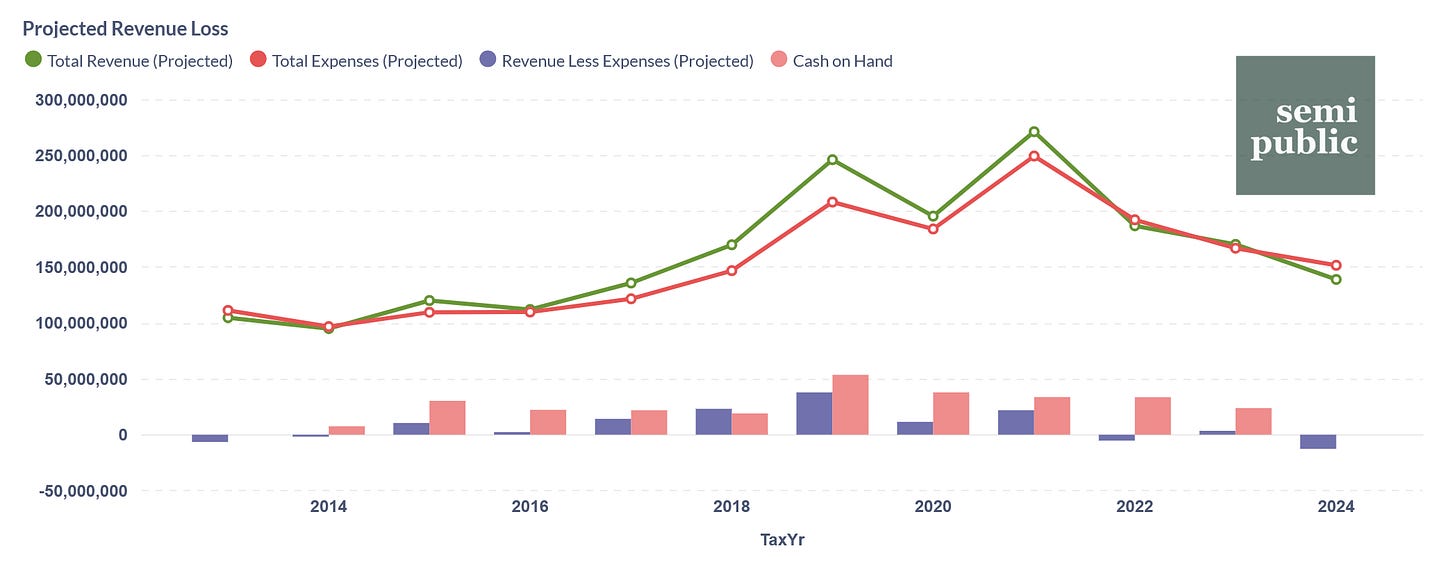

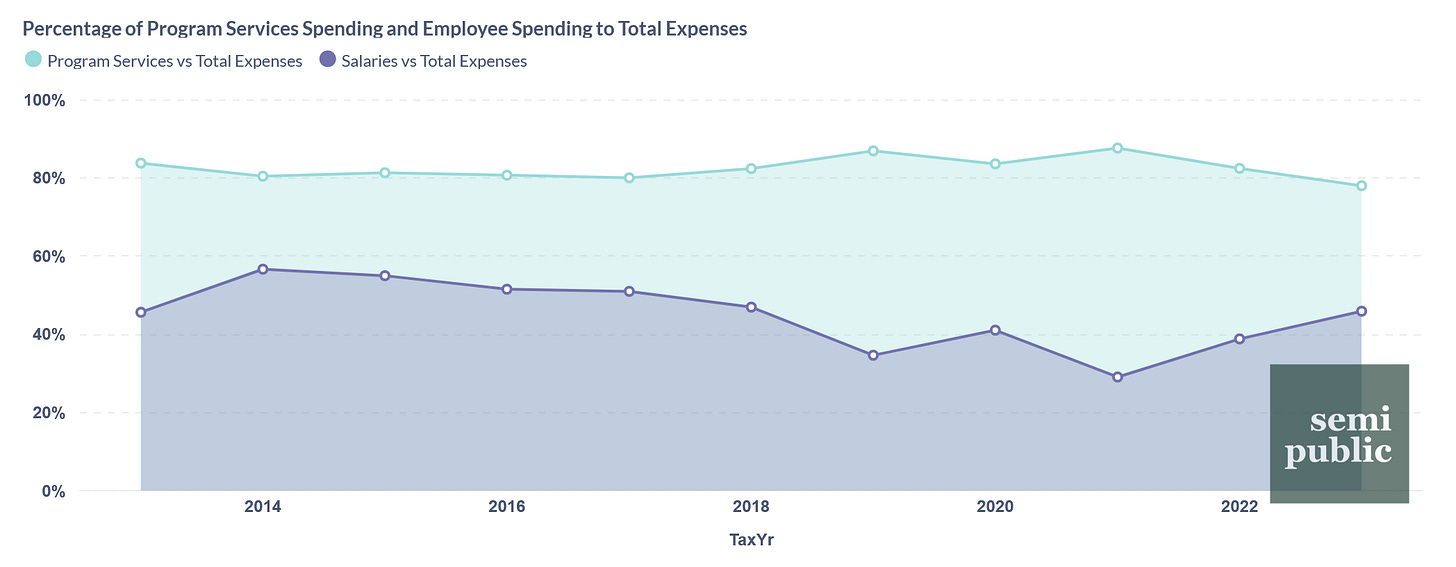

Take a look at the graph above. The green line and shading represents total revenue, while the red line and shading represents total expenses (as reported to the IRS). On the whole, the HBO deal seems to have been very good for Sesame Workshop: Not only did they have a seven-year run of positive net income between 2015 and 2021, but several of those years brought in a lot of income. Additionally, the nonprofit was able to maintain a healthy ratio of how much they spent on program services (represented by the purple line) as a percentage of their total expenses.

What’s interesting is that, as part of the 2015 HBO deal, Sesame Workshop agreed to double their Sesame Street episode output from 18 to 35, but program services expenses don’t start to noticeably increase until 2017. Then, of course, they skyrocket until we hit the banner years 2019 and 2021. 2019 is easy to explain: Sesame Workshop celebrated its 50th season that year with a variety of expensive specials and outreach. My best guess for 2021 is that the spike in both revenue and expenses represents whatever media spending was halted in 2020 due to the pandemic and resumed the next year.

Then, in the summer of 2022, HBO parent company Warner Bros. Discovery made a series of high-profile moves to lower their overhead. Citing the pending merger of their streaming platform HBO Max with Discovery+, the company removed around 200 episodes of Sesame Street from HBO Max and dropped over 40 original titles, including several Sesame Street specials and The Not Too Late Show with Elmo. In one fell swoop, Sesame Workshop lost over 31% of its revenue and broke its seven year profitability streak. And 2023 wasn’t much kinder.

It’s obvious that the nonprofit’s total expenses are directly tied to how much it spends on program services. Interestingly, Sesame Workshop was able to reduce how much they spent on these services from nearly 88% of their total expenses in 2021 to 78% in 2023 - the lowest from any of the years’ data that I collected. Even with this record low, they still only barely remained net revenue positive.

The total Sesame Workshop spent on salaries, executive compensation, and benefits, however, does not seem to follow the same pattern. In fact, while the percentage spent on program services decreased ten points from 2021 to 2023, employee expenses increased by 17 - from 29% of total expenses to 46% - at the same time. It should be noted that this isn’t necessarily a high ratio for Sesame Workshop: Employee expenses compared to total expenses was higher than 46% for every year between 2014 and 2017, sometimes going as high as 57%.

One of the big headlines after HBO announced that they’d be ending their distribution deal with Sesame Workshop was the nonprofit’s reduction in force of (reportedly) 20%. Assuming all job cuts were proportionate to individual income, a 20 point reduction in 2023’s employee spending ($76.5 million x 80% = $61.2 million) would bring the ratio compared to total expenses back down to 37%.

Projecting HBO and Federal Grant losses

In an article from Monday, the New York Times eloquently detailed the double-whammy to Sesame Workshop’s revenue: Not only was the nonprofit losing HBO’s $30 to $35 million a year deal, it was also facing the loss of several federal grants. Using the favorable end of HBO’s reported yearly payments to Sesame Workshop (-$30 million) combined with the nonprofit’s most recently-reported federal grant income (-$7.4 million), the revenue saved through layoffs (about +$15.3 million), and the reported yearly deal HBO struck for Sesame Street’s back catalog (+$6 million), let’s try to predict how much trouble Sesame Workshop was actually in.

Even though they fluctuate wildly from year-to-year, for this projection, we’re going to assume that total revenue and total expenses stayed level in tax year 2024.

Sesame Workshop was looking at a revenue drop of at least $37 million, while only picking up about $21 million in reduced employee expenditure combined with the revised HBO deal. With a slight revenue positive year in 2024, that would have left the nonprofit $12.6 million in the hole. At the end of 2023, the nonprofit reported $23.8 million in cash on hand, which means it could have stayed afloat for about 22 months. That is, unless, Sesame Workshop cashed in one of its many investments. Or used its relatively low reliance on debt (21%, as a function of total liabilities versus total assets) to finance a loan. Or even found an alternative distribution deal in the ballpark of $15 million (though, reportedly, there were not many interested).

With all of that considered, saying that Netflix “saved” Sesame Workshop, I think, isn’t that big of a stretch. Go ahead, you have my permission.

As always, here’s a shareable dashboard containing this newsletter’s graphs and data. If you enjoyed this article, please leave a like. It’s very much appreciated.